Player FM uygulamasıyla çevrimdışı Player FM !

Money Talk Podcast, Friday April 12, 2024

Manage episode 412194822 series 1036924

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 8-12, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

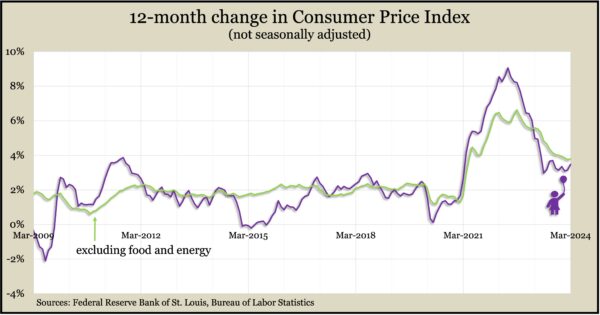

Overall inflation continued to stall in March, staying above the Federal Reserve’s long-term target. The Consumer Price Index, the broadest measure of inflation, rose to a 3.5% year-to-year rate, bouncing higher for the second month in a row after falling from as high as 9.1% in June 2022. The Bureau of Labor Statistics said increased costs for shelter, gasoline and car insurance contributed to faster inflation, keeping it above the Fed’s long-range target of 2%. A core measure of CPI, which excluded volatile food and energy prices, stayed at a year-to-year rate of 3.8% for the second month in a row.

Thursday

Inflation on the wholesale level rose in March with the Producer Price Index gaining 0.2%, only one-third of the advance in February. The Bureau of Labor Statistics said the index rose 2.1% from March 2023, the fastest 12-month pace in 11 months. Costs for services increased while goods prices declined overall, led by gasoline. The core Producer Price Index – excluding volatile prices for energy, food and trade services – rose 0.2% from February and was up 2.8% from the year before, on par with the yearly rate since May.

The four-week moving average for initial unemployment claims dipped for the second time in three weeks, reaching 42% below the long-term average since 1967. The measure of employers’ reluctance to let workers go was 3% above its level just before the COVID-19 pandemic, according to data from the Labor Department. Altogether, just under 2 million Americans claimed jobless benefits in the most recent week, down 3.6% from the week before but up 5% from the same time last year.

Friday

A preliminary April reading of consumer sentiment shows Americans have registered little change since January. The survey-based index from the University of Michigan has been midway between an all-time low in mid-2022 and the optimism level just before the pandemic four years ago. Surveys showed a slight increase in expectations for inflation, which the university said might suggest some frustration with an apparent stalling in the slowdown of inflation.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16175, down 73 points or 0.5%

- Standard & Poor’s 500 – 5123, down 81 points or 1.6%

- Dow Jones Industrial – 37984, down 920 points or 2.4%

- 10-year U.S. Treasury Note – 4.50%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail

13 bölüm

Manage episode 412194822 series 1036924

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Art Rothschild

Mike Hoelzl

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 8-12, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

Overall inflation continued to stall in March, staying above the Federal Reserve’s long-term target. The Consumer Price Index, the broadest measure of inflation, rose to a 3.5% year-to-year rate, bouncing higher for the second month in a row after falling from as high as 9.1% in June 2022. The Bureau of Labor Statistics said increased costs for shelter, gasoline and car insurance contributed to faster inflation, keeping it above the Fed’s long-range target of 2%. A core measure of CPI, which excluded volatile food and energy prices, stayed at a year-to-year rate of 3.8% for the second month in a row.

Thursday

Inflation on the wholesale level rose in March with the Producer Price Index gaining 0.2%, only one-third of the advance in February. The Bureau of Labor Statistics said the index rose 2.1% from March 2023, the fastest 12-month pace in 11 months. Costs for services increased while goods prices declined overall, led by gasoline. The core Producer Price Index – excluding volatile prices for energy, food and trade services – rose 0.2% from February and was up 2.8% from the year before, on par with the yearly rate since May.

The four-week moving average for initial unemployment claims dipped for the second time in three weeks, reaching 42% below the long-term average since 1967. The measure of employers’ reluctance to let workers go was 3% above its level just before the COVID-19 pandemic, according to data from the Labor Department. Altogether, just under 2 million Americans claimed jobless benefits in the most recent week, down 3.6% from the week before but up 5% from the same time last year.

Friday

A preliminary April reading of consumer sentiment shows Americans have registered little change since January. The survey-based index from the University of Michigan has been midway between an all-time low in mid-2022 and the optimism level just before the pandemic four years ago. Surveys showed a slight increase in expectations for inflation, which the university said might suggest some frustration with an apparent stalling in the slowdown of inflation.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16175, down 73 points or 0.5%

- Standard & Poor’s 500 – 5123, down 81 points or 1.6%

- Dow Jones Industrial – 37984, down 920 points or 2.4%

- 10-year U.S. Treasury Note – 4.50%, up 0.12 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail

13 bölüm

Tüm bölümler

×Player FM'e Hoş Geldiniz!

Player FM şu anda sizin için internetteki yüksek kalitedeki podcast'leri arıyor. En iyi podcast uygulaması ve Android, iPhone ve internet üzerinde çalışıyor. Aboneliklerinizi cihazlar arasında eş zamanlamak için üye olun.